Central Bank Gold Leasing

26 November 2012 59 Comments

The salespeople of the gold investment industry publish a lot of bold claims about central bank activities in the gold market (for example, here) along the lines of “All central banks want to suppress the gold price.“, “The central banks have secretly leased and sold most of their gold.” The present article is an attempt to summarize the facts that we know and to offer a rather different interpretation.

If you have additional sources, further data, or a different interpretation, please feel free to comment (just scroll down). I will keep updating and amending this summary as new material comes up.

1. Ambiguous Title ?

Does the leasing of gold (by central banks or whomever else) create ambiguous title of ownership to individual gold bars? The gold investment industry keeps suggesting this although it is easy to see that this claim is false.

Here is how leasing gold works.

Option 1. The London Gold Market (LBMA)

Both parties transact in unallocated bullion accounts. For example, one is an LBMA member and the other one a commercial bank, a hedge fund, or a central bank.

In order to lease gold for 3 months, I sell spot unallocated gold and at the same time purchase a 3-months gold forward contract. The combination of both transactions is a swap. For 3 months, I lease gold to my counterparty and at the same time borrow US$. The amount by which the 3-months forward is more expensive than the spot price, is the 3-months Gold Forward Offered Rate (GOFO). This is the rate I have to pay for the swap. Since I receive US$ from selling spot unallocated gold which I can invest in the meantime for x% annually, I can pocket a rate of x% minus GOFO for leasing my gold. This is the Gold Lease Rate (GLR). (Note that the LBMA publishes their GLR under the assumption that my x% is given by LIBOR which may or may not be the case.)

This way of leasing gold is a financial transaction. The ownership title to individual gold bars is not affected.

Depending on the small print of the contract, my counterparty is allowed to request allocation of their long unallocated position. In this case, the other party receives title to specific gold bars while I no longer have title to these bars. Title is unambiguous. When my forward contract finally matures and my account is credited with unallocated gold, I can similarly ask for allocation and receive title to specific gold bars. These will typically be bars different from those that I originally owned. What was leased was a financial claim on a number of ounces of gold rather than specific gold bars.

The leasing of gold is not a source of ambiguous title to individual gold bars. The only way multiple parties can receive title to the same bar is through outright fraud by the custodian.

Option 2. The New York Commodity Exchange (COMEX)

In order to lease physical gold for 3 months, I can sell physical gold in the spot market (this is outside of COMEX) and at the same time purchase a COMEX futures contract that matures in 3 months. In order to recover physical gold, I can then hold the futures contract into the delivery period. The role of GOFO is now played by the gold base rate, i.e. the amount by which the futures contract is more expensive than the spot price. When I sell my physical gold in the spot market, the title to these bars is passed on to the buyer. Only once I receive delivery on my futures contract, I will regain title to (other) gold bars. Again, title is unambiguous unless the custodian commits outright fraud.

2. Did Greenspan Spill the Beans?

On 24 July 1998, Alan Greenspan testified before the Committee on Banking and Financial Services of the House of Representatives on the matter of regulating Over The Counter (OTC) derivatives. His testimony contains the following lines:

The vast majority of privately negotiated OTC contracts are settled in cash rather than through delivery. […] To be sure, there are a limited number of OTC derivative contracts that apply to nonfinancial underlying assets. There is a significant business in oil-based derivatives, for example. But unlike farm crops, especially near the end of a crop season, private counterparties in oil contracts have virtually no ability to restrict the worldwide supply of this commodity. (Even OPEC has been less than successful over the years.) Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.

This last sentence is often taken as an indication that all central banks, including the Federal Reserve generally lease gold in order to suppress its price. This immediately raises the question of why he would be so unprofessional as to include this comment about gold leasing in a testimony that he had sufficient time to prepare ahead of the meeting, if gold price suppression was such a crucial secret operation. Whom is he really speaking to (certainly not the committee he is addressing), and what is the purpose of this remark?

But first let us dissect this statement step by step. Is the Federal Reserve leasing any gold?

The answer is ‘no’, simply because the Federal Reserve System has not owned any gold since 1934. The balance sheet of the Federal Reserve System contains only gold certificates valued at about $11 billion (Section 10 of H4.1 Release – Factors Affecting Reserve Balances), but no actual gold. With the Gold Reserve Act of 1934, all gold still held by the banking system became the property of the Treasury Department. It is the Treasury Department which owns the foreign exchange reserves of the United States and which is responsible for reserve and exchange rate management. In fact, the Exchange Stabilization Fund (ESF) was created for this purpose. Wikipedia writes

A change in the law, in 1970, allows the Secretary of the Treasury, with the approval of the President, to use money in the ESF to “deal in gold, foreign exchange, and other instruments of credit and securities.”

We can therefore not rule out the fact that the Treasury Department via the ESF intervenes in the foreign exchange market, involving both unallocated and allocated gold on the account of the ESF as opposed to that of the Federal Reserve. Note that the ESF would nevertheless trade through the Federal Reserve Bank of New York albeit on their own account rather than using the official U.S. gold reserve.

This is an important difference between the Federal Reserve, the Bank of England and the Bank of Japan on the one hand and the central banks of the Eurosystem on the other hand. The former three do not have sovereignty over their exchange reserves. This is the responsibility of the governments of the U.S., the UK and Japan, respectively. The governments of the Eurosystem, in contrast, cannot use their gold reserves without approval by the ECB. From the introductory statement to the press conference by Willem F. Duisenberg, President of the European Central Bank, on 8 July 1998:

Before the end of the current year the Governing Council will also have to adopt an ECB Guideline pursuant to Article 31.3 of the Statute of the ESCB, which will subject all operations in foreign reserve assets remaining with the national central banks -including gold – to approval by the ECB.

One consequence of this assignment of responsibilities is the fact that neither the Federal Reserve nor the Bank of England nor the Bank of Japan are independent in the case of a currency crisis. They have to follow the orders of their respective treasury departments. The central banks of the Eurosystem, in contrast, are independent. Duisenberg phrased it as follows:

The euro, probably more than any other currency, represents the mutual confidence at the heart of our community. It is the first currency that has not only severed its link to gold, but also its link to the nation-state. It is not backed by the durability of the metal or by the authority of the state. Indeed, what Sir Thomas More said of gold five hundred years ago – that it was made for men and that it had its value by them – applies very well to the euro.

Alan Greenspan later explained what the term ‘central banks’ in his testimony referred to. From the documents of Reginald H. Howe vs. Bank for International Settlements (2001):

In a letter to Senator Joseph I. Lieberman dated January 19, 2000, Mr. Greenspan elaborated on his 1998 congressional testimony (C. 39; DOJ Ex. E): “This observation simply describes the limited capacity of private parties to influence the gold market by restricting the supply of gold, given the observed willingness of some foreign central banks — not the Federal Reserve — to lease gold in response to price increases [emphasis supplied].”

If it was not the Federal Reserve, then who else leased gold, how long for, and for what purpose? Finally, why did Greenspan mention these facts in public? Obviously, this was not meant to remain a secret. Whom was he addressing here? – Most likely not the Committee on Banking and Financial Services.

3. Estimates of the Amount of Gold on Lease

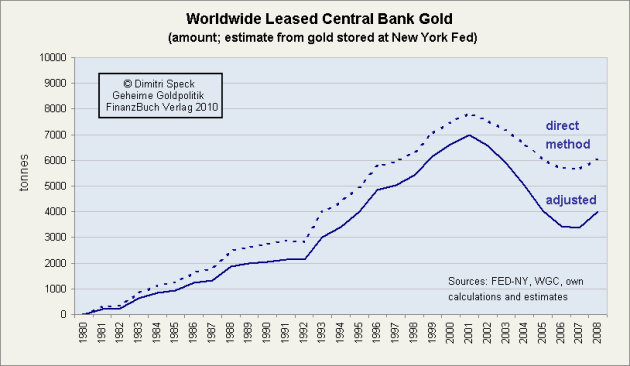

Around the year 2000, several attempts were made in order to estimate the total volume of central bank gold on loan. The consensus estimate at that time was that the amount of gold loans was between 3000 and 5000 tonnes. Frank Veneroso (for example here and here) kept track of the supply and demand statistics and estimated an amount of gold loans outstanding (not necessarily all lent by central banks) of between 10000 and 16000 tonnes. Dimitri Speck came up with an estimate of about 7000 to 8000 tonnes for 2001 (Figure 1 – this is Fig. 37 from his book Geheime Goldpolitik).

Figure 1: Estimate of Worldwide Leased Central Bank Gold, Figure 37 in Geheime Goldpolitik by Dimitri Speck

One main source of data for his estimate is the amount of gold held by the Federal Reserve Bank of New York (FRBNY) on behalf of foreign governments, foreign central banks, and international institutions. What is in essence the inventory of the gold vault under 33 Liberty Street, can be seen from the monthly Federal Reserve Bulletin, Appendix A54, International Statistics, Item 3.13, Foreign Official Assets Held at Federal Reserve Banks, Line 3, Earmarked gold. The amount of gold held in custody is given in millions of US$ worth of gold valued at the current official gold price of US$ 42.22 per ounce. Figure 2 shows the weight in tonnes.

Figure 2: Foreign Official Gold held at the Federal Reserve Bank of New York (source: Federal Reserve Bulletin)

Basing the estimate for the amount of gold on loan on this vault inventory is very plausible because the FRBNY serves as the custodian for almost 30% of the non-US official gold reserves. The inventory may decline for various reasons, among them outright sales of official gold by a foreign government, central bank or an international organization, the leasing of gold in the case in which the counterparty requests allocation of the leased gold, as well as plain relocation of the gold to a different custodian, not involving any sale or lease.

Furthermore, if a foreign central bank sells or leases gold, they will most likely use the gold held in New York first (and perhaps gold located in London) before they touch any gold held at other locations. This is because they acquired most of this gold as a consequence of a balance of payments surplus against the U.S. under the Bretton Woods System, and so this gold was initially located in New York when they received it. It is therefore more likely that they will eventually want to repatriate this gold rather than move any additional of their gold from other locations to New York.

From Figure 2, we see a decline of the inventory by about 4400 tonnes between 1982 and 2002. Since 2002, the inventory has been stable except for a drop by 405 tonnes between 2007 and 2008. Note that the International Monetary Fund (IMF) sold 403.3 tonnes in 2009 and 2010. What a coincidence! Recall from Section 1 that the leasing of unallocated gold and the change of title to the gold need not coincide in time. In a similar way, gold that is sold can initially be sold as unallocated, i.e. as a financial claim, and be allocated only later. Or it can be leased, allowing the counterparty allocation and be officially sold only later. Since we cannot confirm that the gold sold by the IMF in effect came from this vault, this possibility remains a speculation. Furthermore, more than half of the IMF sales went to official entities (India, Mauritius, Sri Lanka, Bangladesh), and it is not obvious whether they would have removed it from the New York vault or not.

In summary, we observe a steady decline of the FRBNY vault inventory by about 4400 tonnes between 1981 and 2002, and little change since then (if the outflow in 2007 and 2008 was indeed explained by the IMF gold, the inventory has been unchanged since 2003 up to a discrepancy of less than 5 tonnes!). Figure 3 shows the annual change of the amount of foreign gold held at the Federal Reserve.

Figure 3: Annual change of the amount of foreign gold held at the Federal Reserve (source: Federal Reserve Bulletin)

If the IMF gold sales originated from this vault, Figure 4 shows the situation without these sales (we simply added 201.65 tonnes to the inventory in each of the years 2007 and 2008).

Instead of the volume of gold leasing which can be an unallocated transaction, let us rather pay attention to the ownership of physical gold by non-US governments and central banks, a significant part of which can be seen from the FRBNY custodial holdings. This leads us to the following questions:

- Why did non-U.S. governments and central banks give up ownership title to at least 4400 tonnes before 2002?

- What changed around 2002, and why have they not given up title to any further gold since then?

Before we proceed to the question of what changed in 2002, we remark that Another gave an estimate of the total volume of LBMA unallocated gold outstanding in spring 1998: 10000 tonnes. This is well in line with Frank Veneroso’s estimates cited above.

Another’s figure, however, refers to the financial claims on gold rather than to the gold on lease. There is a crucial difference between these two figures. If an investor holds unallocated gold with a bullion bank (BB), i.e. a part of the 10000 tonnes alluded to by Another, the BB needs to hedge this exposure. They can hedge it in many ways, for example, by holding a physical reserve, by borrowing gold (allocated or unallocated) from a central bank, or by matching it with a forward sale from a mining company or by a short sale by a mining company that was intended as a price hedge. Only one of these possibilities refers to central bank gold on loan.

4. The Tide Turns in 1999

As Greenspan said, before 1999, it was foreign central banks who leased gold, mainly the Europeans. This is the story of supporting the dollar which was the only significant currency for international trade, and the story of lowering the dollar oil price by lowering the dollar gold price. The falling dollar gold price made gold less attractive to private investors, and the weak hands sold, providing the gold that the oil exporters wanted to purchase without running up the price. FOFOA summarized this story beautifully in his It’s The Flow, Stupid! and Flow Addendum. Let us just quote Another for an outline.

Date: Sun Oct 05 1997 21:29

ANOTHER ( THOUGHTS! ) ID#60253:[…] This line of thinking is very real in the world today but it is never discussed openly. You see oil flow is the key to gold flow. It is the movement of gold in the hidden background that has kept oil at these low prices. Not military might, not a strong US dollar, not political pressure, no it was real gold. In very large amounts. Oil is the only commodity in the world that was large enough for gold to hide in. Noone could make the South African / Asian connection when the question was asked, “how could LBMA do so many gold deals and not impact the price”. That’s because oil is being partially used to pay for gold! We are going to find out that the price of gold, in terms of real money ( oil ) has gone thru the roof over these last few years. People wondered how the physical gold market could be “cornered” when it’s currency price wasn’t rising and no shortages were showing up? The CBs were becoming the primary suppliers by replacing openly held gold with CB certificates. This action has helped keep gold flowing during a time that trading would have locked up.

(Gold has always been funny in that way. So many people worldwide think of it as money, it tends to dry up as the price rises.) Westerners should not be too upset with the CBs actions, they are buying you time!

So why has this played out this way? In the real world some people know that gold is real wealth no matter what currency price is put on it. Around the world it is traded in huge volumes that never show up on bank statements, govt. stats., or trading graph paper.

The Western governments needed to keep the price of gold down so it could flow where they needed it to flow. The key to free up gold was simple. The Western public will not hold an asset that going nowhere, at least in currency terms. ( if one can only see value in paper currency terms then one cannot see value at all ) The problem for the CBs was that the third world has kept the gold market “bought up” by working thru South Africa! To avoid a spiking oil price the CBs first freed up the publics gold thru the issuance of various types of “paper future gold”. As that selling dried up they did the only thing they could, become primary suppliers! And here we are today. In the early 1990s oil went to $30++ for reasons we all know. What isn’t known is that it’s price didn’t drop that much. You see the trading medium changed. Oil went from $30++ to $19 + X amount of gold! Today it costs $19 + XXX amount of gold! Yes, gold has gone up and oil has stayed the same in most eyes.

Now all govts. don’t get gold for oil, just a few. That’s all it takes. For now! When everyone that has exchanged gold for paper finds out it’s real price, in oil terms they will try to get it back.[…]

Date: Sun Oct 12 1997 10:42

ANOTHER (THOUGHTS!) ID#60253:How DO they do it?

It’s more complicated than this but here is a close explanation. In the beginning the CBs didn’t sell their own gold. They ( thru third party ) found someone else who had bullion. That “party” sold to a broker who sold forward for a mine or speculator or government ) . In the end the 3rd party had the backing from the broker that he had backing from the CB to supply physical if needed to put out a fire. The CB held a very private note from the broker as insurance and was paid a small fee. This process mobilized free standing bullion outside the government stockpiles. The world currency gold price was kept down as large existing physical stockpiles were replaced by notes of future delivery from the merchant banks ( and anyone else who wanted to play ) .

This whole game was not lost on some very large buyers WHO WANTED GOLD BUT DIDN’T WANT IT’S MOVEMENT TO BE SEEN! Why not move a little closer to the action by offering cash directly to the broker/bank ( to be lent out ) in return for a future gold note that was indirectly backed by the CBs. That “paper gold” was just like gold in the bank. The CBs liked it because no one had to move gold and it took BIG buying power off the market that would have gunned the price! It also worked well as a vehicle to cycle oil wealth for gold as a complete paper deal.

[…]

Date: Thu Nov 13 1997 09:34

ANOTHER (THOUGHTS!) ID#60253:It was never the intent of the CBs to sell their countries gold in massive amounts. The “understanding” that was worked out years ago was good for the economies and the world. In return for the US$ remaining the “oil reserve” currency, ( oil would be not just supplied but supplied in dollars ) large amounts of gold would be supplied far into the future. The gold, while indirectly backed by the CBs would actually come from the mines of the future. With the oil money making a ready market for gold priced at a premium ( contangoed out many years ) , the mines could make a fair profit even with spot gold priced below production. All would win! And for some time, we did! I am able to know some CBs, they are not evil, their minds are for the best that can occur. But, I THINK the world ran away from them. The paper world of gold is now a mess with no resolve! They will not sell all gold. Some that have actually have paper for future return. […]

The following is FOA on the politics involved.

5/27/98 Friend of ANOTHER

This article (see below) puts a different light on the Euro. I think a major effort was underway for many years to unseat the dollar. It was only after the gulf war politics that the EURO group saw a way to use gold to draw in the oil producer currency backing. It was clear that the dollar was going to someday fall from reserve currency status because of it’s compounding debt load. With nothing to replace it, gold would become the world oil currency, as Another says.

Initially, they built the Euro with little talk of gold, all the while building a paper gold market that is dollar settlement based. By increasing the Gold Trading Market with paper gold, it not only drove the gold price down, but gave these contracts credibility as they could be settled in a strong dollar via gold. The hook came when they suddenly wanted gold as part of the reserves for the Euro! Now the BIS just stops supporting the London market with Central Bank gold loans and sales. By the time for the Euro to debut , gold starts to rise through the $360 area, there by breaking the entire dollar based paper gold market! Every oil state, and anyone else that is holding paper gold, will try to first exchange it for physical. After that guess who will be waiting with a brand new hard world reserve currency, ready made for converting dollar gold loans into Euro gold loans!

The dollar will not necessarily be destroyed by inflation at first, but you can be sure it will collapse in terms of gold. In this process, if everyone try’s to spend their overseas dollars (presently Eurodollars), the US will no doubt invoke foreign exchange controls and most likely create a new currency. I think, that’s where ANOTHER gets the $30,000+ business for existing (replaced) dollars and I don’t doubt it one bit. This is why everybody keeps getting lost in the falling gold price. They keep working it like it’s the old physical market years ago. It’s not the same. Anyone that try’s to leverage it in any way will just keep getting pounded as London prints gold for all their worth until the Euro takes effect.

[…]

6/2/98 Friend of ANOTHER

[…]

The Middle Eastern bullion holdings are well hidden from official records. They control the gold market through the London/European gold paper markets. It was the BIS that handed them the market when it created the Central Bank lending deals. They were the prime buyers right off the bat! I didn’t understand until about a year ago, how they were gaining control without cash. The answer is they don’t buy the paper gold with cash! The Bullion Banks take oil reserves as collateral for it. The money that ends up in the account for a typical mining company forward deal is really a loan against oil in the ground. That’s why the CBs lend the gold so cheap, it’s not for the mines, it’s for the producers! Now you know how we buy cheap oil prices. The world thinks the CBs are doing this for a 1% return. Truth is, the mining industry is going to pay full interest in the end. It’s one hell of a complicated affair, with the politics and all. Needless to say, as the events open up and expose some of this, the public is going to be very interested. As for the SNB selling half of their gold. If they do, it will be for Euros, you can bet on it!

[…]

FOA (5/8/1999; 20:16:12MDT – Msg ID:5772)

BOE![…]

Many different factions are maneuvering gold these days, and each has their own agenda. The IMF / dollar faction, many years ago, went along with Europe in lowering the gold price in dollar terms. It made the dollar look stable and enforced it’s continued use as the “currency of settlement” for strategic commodities. Any country running a balance of trade surplus of dollars, was free to buy gold at a stable to lower price, and partially replace the paper dollar reserves. Because the dollar is the “world reserve currency” many countries ran dollar surpluses with trading partners outside of the US. In this light we can see how the integrity of the dollar was expanded, even in countries of nonnative dollar origin!Not only was physical gold purchased, but paper gold with distant CB backing was also accepted. Ever wonder how all of this gold was placed? You see, over the last many years, there has been a quiet boom going on in gold ownership. The sheer number of world gold buyers has more than doubled, along with the amount of gold owned! The problem is that the amount of physical gold in existence has not doubled, only the warehouse receipts.

Most of it never, ever left the vaults, as the true placement was done in receipt form. Yes, slowly, over the years, even major private bullion holders offered up their physical for “convoluted, future delivered, leased and released gold”. Much of what is now held is little more than a form of gold options for “future deposit”. Not unlike the “cash dollar that is supposed to be in your bank”, but really isn’t? As the bank only holds your deposit as a “credit” to your account, so is much of the world traded gold “only a credit of account”!

When Central Banks (mostly the European, at first) began to lease / lend gold, they were beginning what was to become “the master plan”. The creation of a broad, liquid paper gold market that would ulltementally undermine the dollar, in time. As I said above, initially it was offered as an “appeasement” for continued dollar use. However, even the IMF / dollar faction never expected the successful creation of another competing reserve currency, the Euro! Right up to it’s offering, the political money was on the side of a complete failure, 100% with ten to one odds.

Not only did they lose, the Euro even accepted a percentage of gold as Euro reserves. If that wasn’t enough, the ECB also instituted a policy of “marking to the market” it’s gold reserves and effectively blocking any new sales or leases. These actions, as subtle and misunderstood as they were have had the effect of officially making gold money again. Yes, this new broadly traded paper gold market, standing side by side with the physical market has become a world currency.

The problem this creates for the IMF / dollar is that most, if not all of this new gold market is settled in dollars! Dollars that broke a contract with the world in 1971 and went off the “gold exchange standard” at $41 to the ounce. The same dollar reserve currency that is not supported when the gold price rises. If the ECB does nothing but stand firm by not allowing physical out of it’s vaults, the dollar will be trapped by gold. The US treasury cannot use gold as a backing reserve as the ECB does, because the BIS would claim it at $41 to settle trade imbalances. They have that authority and as such it leaves the US the only option of outright gold sales. However, with the dollar as “the” reserve currency, we can expect many nations to bid “aggressively” for any US gold. China, among others comes to mind! That is what America found when they tried to auction it’s gold in 1978. The Euro carries no such baggage.

This all leaves us in the present political situation, where the IMF entity, that was formed to replace the gold standard, is now trying to back the present paper gold with physical to prevent a run on the dollar. It is a futile effort as the ECB / BIS have grown the gold market into massive proportions by encouraging the many year expansion of holders through paper securities. All denominated, ultimately, in dollars. We will see $10,000 gold, count on it! It’s the only way this can be resolved. That same figure will create massive backing for the Euro and hasten it’s journey into world reserve currency status. Expect most of the ECB liability for gold to be easily converted into Euros at the dollars expense.

[…]

The US now has no choice but to encourage gold to rise and use that action as a political ploy. They will no doubt try to gain much mileage out of the fact that the treasury has 8,000 tonnes of gold for dollar backing or outright sales. It will be a political discussion, only. As the gold market becomes more dynamic and gains media attention, many congressional investigations will target the short funds. After all, with gold killing the dollar, something must be done.

FOA (5/11/1999; 08:34:18MDT – Msg ID:5911)

Reply“Is it possible the the Middle East oil states have been mislead as to the bigger picture from the very beginning?”

[…]

I, personally, think they were for a while. After all, the Euro group will, just as the US group, take all the power they can get!

[…]

If they did suspect that the BIS was playing them into a “new World Order” then that explains their use of the “gold card”. It was allowed to be known that the failure of the Euro to replace the dollar would bring on the reprice of oil using partial payment of a tiny fractional gold amounts per barrel in the settlement mix. Real gold, not paper! It would have forced every oil producer in the world to follow as the gold price would have blew past $30,000 as the new oil currency. Quickly, at the last minute, the ECB and the BIS announced that Euro system Central Banks would stop all selling and wind down leasing. Then gold was brought into the reserve mix for the Euro. Perhaps a counter play? You bet!

FOA (5/11/1999; 18:47:49MDT – Msg ID:5952)

PH in LA (5/11/99; 9:59:21MDT – Msg ID:5920)[…]

During the last number of years, possibly most of the 90s, the gold market was expanded tremendously. The result was that the holders of “paper gold” and “physical gold”, as a group, now own more gold than exists! Is no wonder that the “technical analysis” and “supply / demand” “investment managers” are in a shambles to explain the workings of this new market. Truly, as said before, they are commodity analysis, not political currency analysis. For them, a cornered market must be soaring to reflect the imbalance of longs and shorts. Now can one understand that gold, the political money, is managed on a world scale for the purpose of control of currencies.

From the beginning, the BIS knew that if gold ownership was spread far and wide by leasing from a few European banks, one day, gold would control the value of the dollar.[…]

FOA (5/21/1999; 11:27:15MDT – Msg ID:6570)

Reply[…]

Just because the US said, in 71 that it would not ship gold any more does not mean the dollar isn’t still a contract to represent it’s old international obligations. Every analysts makes comments like, “let them sent their army if they want it”, but that is simply not the way the world works. It’s cheating, fair and simple! Why didn’t the US send out all of it’s gold at $41 to the ounce, then go off the system? As Another say’s, “think long and hard on that one”!The entire international financial structure is based on procedure protocols that are not binding, repeat, not binding, but without them, the system will not work. If the BIS did not coordinate inter bank (CBs) transfers the whole system would stop. Using the same “line of reasoning”, the US cannot just back it’s currency with gold at say, $10,000 and start all over again. What manner of “rules of engagement” would prevent them from halting gold shipments again? “Come on”, people of the world are not that stupid!

No, the dollar would have to be totally destroyed, and a new currency, sanctioned by the BIS, and most likely controlled by them, would have to be created. The US will go down to the wire before that happens, therefore, the Euro was created!

[…] The IMF is a function of the dollar reserve dynamic. If the IMF did not the guarantee dollar debt of countries that could not pay, it would start a chain reaction of dollar reserve destruction. When dollar assets (debt) is no longer serviced (interest paid and debt rolled over) it no longer can be carried on the books as the backing for local currencies. Hence forth, all currencies that are based on this system are “imploded”. Now you see why the IMF does such “perceived dumb” maneuvers, it’s to maintain the dollar, not rebuild the foreign economies.

When the BIS, ECB and the other major world economies are ready to drop the dollar, they will stop supporting the IMF and pull out. The IMF “needs” their support, they do not need the IMF. Likewise, if the US ever disassociated itself with the BIS, they would simply stop all transfers of dollars and most likely buy gold in the open market with them! At that point the Euro would become the only tradable currency. Simple political blackmail, or should I say “international protocols”. It’s nothing new, but some call it a new “world order conspiracy”. They just haven’t liven through enough years, as Another has.[…]

Finally, here is Another on this topic:

5/3/98 ANOTHER (THOUGHTS!)

Mr. Kosares, Your friend thinks much of this gold owned by the USA. It could be used to back the dollar up to 25%, no? Many come to this thinking and hold a secure thought, that as last resort, this gold will save the day! I think, many persons never gained the understanding that the American gold is kept by the “Treasury”, not the maker of your money, “The Federal Reserve”. It is there for good reason, as the present world currency system is not a function of American law! If the US were to place gold in the hands of the US/CB as reserves for the dollar, the BIS could claim it! It is, as a point of contention and of no real use. I think not a war would come of this claim, if it should happen! As the world currencies are now, a “new dollar” would be needed if gold were used as reserves! The present dollar would then, truly be as “paper for the wall”!

The urgent drive to create a new “reserve currency” began in the early 80s, after the last small “gold war”. The road to making this new Euro did never include gold in large amounts, until the last few years! Even one year ago, the news would say, 5% or less. Today, we speak of a much greater amount! This is interesting, yes? The BIS did “hatch” this deal in a very late fashion! The future of the Euro was found to be “weak”, as the Middle East oil imports onto the continent would continue in dollars! This was so from the dollar being made strong in gold. Gold priced in dollars at near production cost, offered a “no switch currency” position, for oil. This position has been unstable for the last year, and the alternative of a switch to gold was in progress! You have read my “Thoughts” before. Now the BIS does offer to “change the rules of engagement”, a real reserve currency is offered!

Few do grasp what is happening and why! They think the holding of gold reserves by the Euro is of a little point, as to what good are gold reserves? One cannot use gold as Marks or Yen to intervene in currency market to support the Euro. My friend, the BIS has played the, as you say, “big poker hand”! The holding of large reserves by the ECB and the withholding of sales from the market will not only bring the end of the London paper gold market, it will, thru a high USD gold price, “make the dollar weak in gold”! From this position, the dollar will lose the “oil backing” from the Middle East! At first, all oil for Europe will be in Euro’s, then all producers want “strong currency”!

There is more: Many say, how to defend Euro without much currency reserves? If gold go to many thousands US, what will be used to bid for Euro as defense? I say, these persons will find a problem on their computer screens! You see, the Euro will start as “nothing”, no holdings of size, anywhere! The dollar is held as reserves as “the stars in heaven”! It is to say, “the dollar will bid for the Euro”, not “the Euro will bid for the dollar”! All currencies will “flow into the Euro for trade”. But, if the Euro becomes so strong, how to compete in world trade? It will be the price of oil that will make the “trading field” level! The soaring US$ price of gold will make even a 10% Euro reserve be as 100% today, in USD! Oil will become, very, very cheap in Euros and allow that economy to do well! Many other countries will see this and also want to join the new “world reserve currency” that has become”the new world oil currency”!

We have seen that the central banks of the Eurosystem stopped all leasing and further selling of gold with the introduction of the Euro. The following message was probably the first piece of information on this new policy.

Date: Wed Nov 12 1997 14:08

ANOTHER (THOUGHTS!) ID#60253:[…] A person thinking of purchasing physical gold should see the Bundesbank statement as fact. They openly admit to lending in the past and no chance of selling real gold in the future. This is a clear indication that a solid decision was made at the BIS meeting ( see my post ) ! All CBs will now slowly stop all leasing operations and allow the market to size itself. The important players, the oil states, will have their paper covered without question! But, for all others, the great scramble is about to begin!

Oil now must rise if the US$ and the currency system is to survive. […]

Date: Wed Nov 12 1997 20:41

ANOTHER (THOUGHTS!) ID#60253:[…] A BIS meeting was held and from those doors the world did change. The Bundesbank has now made clear to all what will now be policy for CBs. A crisis is at hand! All physical gold sales will stop. All gold lending will wind down. We will see the results of this as a massive scramble to cover open positions slowly unfolds. […]

Had the Bundesbank lent out any of their gold? Dimitri Speck has studied their annual reports in which the interest income from gold leasing is listed and uses this revenue and the average Gold Lease Rates in order to estimate the amount of Bundesbank gold on loan. He finds that gold leasing started in 1996 or 1997, that a maximum of 350 tonnes of their 3396 tonnes were on loan, and that the leasing had ended by 2006, up to a remaining balance of at most 50 tonnes. This is consistent with their published statements that they never leased more than 10% of their total gold holdings. The following is the reply by Bundesbank officials to an enquiry by Dimitri Speck, Appendix 2 of Geheime Goldpolitik (translation by Martin S.):

Deutsche Bundesbank

Wilhelm-Epstein-Straße 14

60431 Frankfurt am Main

28 September 2007

Your enquiry about the gold holdings of the Bundesbank

Dear Mr. Speck,

as part of their management of their gold reserve, the Bundesbank lends a proportion of their gold holdings, albeit very small, to selected banks. The amount of the leased gold varies depending on the market situation, but always remains within a one digit percentage range. The gold lending transactions are mainly short term and exclusively with international banks of the highest credit rating. This procedure has not changed, and so we cannot confirm any rumours to the contrary. This implies that the vast majority of the gold holdings would be available physically on short notice.

Yours sincerely,

Deutsche Bundesbank

(Market Operations Division)signed: Griep, Breves

Upon reading the first draft of the present article, Dimitri Speck emailed me

The Bundesbank stopped lending in the year 2008 (I got confirmation for that).

Best wishes, Dimitri Speck

The policy of winding down all gold lending operations alluded to by Another already in November 1997 was finally officially announced on 26 September 1999. At the IMF meeting in Washington, the central banks of Europe published the following statement that is now known as the Washington Agreement on Gold:

26 September 1999 – Joint statement on gold

European Central Bank

Oesterreichische Nationalbank

Banque Nationale de Belgique

Suomen Pankki

Banque de France

Deutsche Bundesbank

Central Bank of Ireland

Banca d´Italia

Banque centrale du Luxembourg

De Nederlandsche Bank

Banco de Portugal

Banco de España

Sveriges Riksbank

Schweizerische Nationalbank

Bank of EnglandIn the interest of clarifying their intentions with respect to their gold holdings, the undersigned institutions make the following statement:

- 1. Gold will remain an important element of global monetary reserves.

- 2. The undersigned institutions will not enter the market as sellers, with the exception of already decided sales.

- 3. The gold sales already decided will be achieved through a concerted programme of sales over the next five years. Annual sales will not exceed approximately 400 tons and total sales over this period will not exceed 2,000 tons.

- 4. The signatories to this agreement have agreed not to expand their gold leasings and their use of gold futures and options over this period.

This agreement will be reviewed after five years.

What is the meaning of the phrase `with the exception of already decided sales‘? Have you ever read this phase, an `already decided sale‘, in any financial statement? Now compare this with the amount of gold held in by the FRBNY on behalf on foreign central banks with our adjustments (Figure 4).

Looking at the figures, one might think that an `already decided sale‘ refers to gold that was leased and had been allocated to a third party and therefore no longer appears in the inventory of the foreign official gold. Title to this gold will not be demanded back, and the gold will later be sold in a financial transaction that involves only unallocated gold. We arrive at the following.

Conjecture 1.

The central banks of the Eurosystem had sold and leased a substantial amount of gold as of 1999. Some of this gold had been allocated to new owners before 1999. But these central banks have not given up title to any of their gold ever since. All official gold sales by these central banks after 1999 were only on paper, closing an open lease and not demanding the gold back.

If this is what is meant by an `already decided sale‘, this might be the blue print for the IMF gold sales in 2009 and 2010. Recall that the FRBNY gold inventory decreased not in 2009 and 2010, but rather two years earlier when the gold market was at the brink of failure in 2008 (for more details on why the London gold market is at risk from falling prices more so than from rising prices, please see FOFOA’s Today’s (quote-unquote) “Gold”).

Conjecture 2.

The IMF leased gold during the financial crisis in 2007 and 2008 and allowed allocation of this gold to the borrower. Only later, in 2009 and 2010, this gold was officially sold and the lease closed in a paper transaction.

If true, the 212 tonnes of IMF gold that were eventually sold to the central banks of India, Mauritius, Sri Lanka and Bangladesh must have been physically sourced elsewhere. But at least the remaining 192 tonnes had been on lease all the time, and therefore their sale was merely a paper sale, i.e. unallocated. Was this the reason why Eric Sprott could not buy the gold that the IMF wanted to sell? Finally, this incident would indicate that about 400 tonnes of allocated gold was sufficient in order to rescue the London gold market in 2007/2008.

The following remark by Another on the gold sales by the Bank of England is consistent with our interpretation of the term `already decided sale‘:

Date: Sat Apr 25 1998 23:35

ANOTHER (THOUGHTS!) ID#60253:[…] Many think the only way gold can rise in dollar terms is if USA prints to many! Truly, they have printed to many already. Gold will rise in dollar terms, many thousands even if treasury inflates currency no more. This rise in price will cost London much! You have seen the Bank of England report of gold that does not come home? […]

The big picture that emerges, is the following. Since perhaps November 1997, but definitely since September 1999, the central banks of the Eurosystem have stopped all further leasing operations and have not given up ownership title to any of their physical gold. They have been sitting tight ever since.

Only the core supporters of the US dollar, among them the IMF, have continued to occasionally intervene in the gold market in order to avert a market collapse. This view is supported by the following anecdote on the days following the publication of the Washington Agreement, reported in the complaint by Regnald H. Howe vs BIS (2000):

According to reliable reports received by the plaintiff, this effort was later described by Edward A. J. George, Governor of the Bank of England and a director of the BIS, to Nicholas J. Morrell, Chief Executive of Lonmin Plc:

“We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The U.S. Fed was very active in getting the gold price down. So was the U.K.”

Notice that Edward George allegedly said that the Fed and the UK were very active. He did not mention the central banks of the Eurosystem. The signatories of the Washington Agreement on Gold were the central banks of the Eurosystem plus the central banks of Sweden, Switzerland, and the Bank of England. The alleged remark by Edward George might indicate some duplicity by the Bank of England: they signed the Washington Agreement and then immediately intervened in order to limit the damage to their London gold market. Also note that the Bank of England did not sign the renewal of the Central Bank Gold Agreement in 2004.

Figure 5: The Gold Forward Offered Rate (GOFO) between September 1999 and November 1999

(source: London Bullion Market Association (LBMA))

Did Edward George stare into the abyss? You bet. Figure 5 shows the Gold Forward Offered Rate (GOFO) for September to November 1999. The day of 29 September 1999, the Wednesday after the announcement of the Washington Agreement, saw the greatest backwardation in the history of the London gold market.

For the record, we mention that the Washington Agreement has since been renewed twice: on 8 March 2004 (with annual sales of up to 500 tonnes rather than 400 tonnes, and without the Bank of England as a signatory) and on 2 August 2009 (with annual sales down to 400 tonnes, again without the Bank of England as a signatory, and this time without mentioning gold leasing). Figure 6 shows the gold sales recorded under these agreements:

Figure 6: Gold sales under the Central Bank Gold Agreements (source: World Gold Council)

Note that the gold sales by the United Kingdom are recorded in this diagram although the UK has not signed the second agreement starting in September 2004. The gold sold by Germany was exclusively for commemorative coins and was therefore obviously a sale of physical gold. The IMF sales are included in the diagram although the IMF is not a signatory. Our Conjecture 1 above asserts that all other sales by signatories of the agreements were sales on paper of gold that had already been leased and that had already left the vaults. Note that the total amount of such gold sold under the Central Bank Gold Agreements is about 3800 tonnes – well in line with the consensus estimate on the total amount of gold on lease of 3000 to 5000 tonnes as we mentioned at the beginning of Section 3.

Our conjecture also implies that the published supply and demand statistics that view gold as a commodity, were wrong because they record the official gold sales on the dates on which the unallocated transactions were booked rather than on the dates on which the physical gold was made available. Figure 7 shows the annual change of the reported official sector gold holdings:

Figure 7: Annual change of official gold holdings (source: World Gold Council)

The change of the trend from sales to purchases occurs around 2008.

If our Conjecture 1 is true, then this change of the major trend must have occurred much earlier. Figure 8 shows the same data, assuming that all gold sales under the Central Bank Gold Agreements, i.e. all sales shown in Figure 6 except those by the IMF, were paper sales only. We have therefore removed them from the data (Note, however, that we have not added this outflow before 1999 when the gold was initially leased). Figure 8 also assumes that all other changes to the official gold reserves were transactions in allocated gold. Finally, the 454 tonnes purchased by China that were recorded in 2009, are spread out over the preceding 6 years. We see that the change from an outflow of official gold to an accumulation of official gold begins in 2000 and finally reaches a new order of magnitude in 2008.

Although we know that the London gold market is dominated by the trading of gold credit and gold derivatives as opposed to physical gold, it is interesting to note that the trend of the dollar gold price reversed at roughly the same time, namely between 1999 and 2002 (Figure 9):

Figure 9: London (pm) Gold Fixing in U.S. Dollars from 1 January 1997 to 28 September 2012. The black line is the best fit of an exponential function to the gold price since 1 January 2002 (regression line in the logarithmic diagram). Its annual rate of increase is 19.4%. On 28 September 2012, the dark blue channel extends from $1612 to $2015 per ounce and the light blue channel from $1442 to $2253.

5. The U.S. Gold

Between August and September 2000, the U.S. Treasury Department changed the terminology for the part of the U.S. gold reserve stored at West Point from Gold Bullion Reserve to Custodial Gold Bullion. In gold bug circles, this lead to rampant speculation that this gold had been sold, leased, or swapped. The issue was eventually clarified by changing the terminology to Deep Storage, in contrast to the Working Stock of the U.S. Mint. One can even interpret the term Deep Storage to mean that this gold is not intended to be used (as long as the U.S. dollar is around in its present form).

The following is FOA on the Gold Trail on the term Custodial Gold:

FOA (04/23/01; 20:30:04MT – usagold.com msg#67)

Replies and Custodial Gold[…]

I suspect the gold in West Point was reclassified in a show of good faith to those that own some international gold paper. I’m talking about people who’s reasonably priced product you cannot live without. I doubt the gold has outright swaps written against it or was swapped into the enemy’s camp (so to speak). While the ESF has the right to trade currency swaps against other’s gold (and they do do this). Our gold has yet to be possessed by others. Just as in 1971, when many dollar holders thought US gold was “in custody” for them, so to does the current world dollar gold markets. However, this open certification shows just how tight the system has become.We have said for some time that the dollar faction has inflated paper gold and done so with very limited actual bullion of their own. We maintain that most of the leverage created in this arena has been done with the gold of private Western owners. Modern GoldBug owners that once held physical gold but now seek gold leverage and gold industry investment instead of gold wealth. That gold has now been leveraged for all it’s worth as it filled the use void. Today, we are reaching the mathematical end that that game can be played. Others know this and the West Point business is an attempt to counter this perception. Even if it was only a political move. We are getting close though (smile).

There is no logic in that the Bundesbank would risk it’s gold. They were major supports of the Washington Agreement. Counter to perception, the entire EuroZone CB system awaits the day when they can convert failed paper gold borrowers into Euro borrows. As our paper gold market fails to function, shuts down and physical gold soars, there will be no bookkeeping market to offload these paper positions into. The conversion ratio into Euros will then be something to behold. Along with the demand for currency Euros and physical gold! The BIS /ECB is delighted that the dollar faction is lending all the “gold on paper” the dollar market can stand. Eventually, the US will walk right up to the gold window with the intentions of selling, only to fall away as they stair at a mountain of foreign CB dollars.

[…]

Trail Guide (04/24/2001; 20:23:14MDT – Msg ID:52494)

Replies that help articulate[…]

Sir, We need to remember that most of this “showing off of gold stores, from this point forward will employ a lot of political gamesmanship. Not unlike the BOE auctions. In that case they aren’t really selling that much gold into the market. The BIS could have taken it all real easy, but England wanted to drag it out for effect. That way they got the most exposure and time. Allowing some of their favorite BBs to escape before the Pound goes EMU.In the same light, most of the real gold that has left the CBs ended up in other CBs as statistics show. Political gamesmanship! Same thing is in process with our West Point business. Political jockeying for more mileage. As an example; watch a newcomer ride into town pulling an open trailer of cash. Every real estate broker from miles around will be at his feet. Now. that cash isn’t in their possession, is it? Yet, it sure looks like it’s been put on a trailer format for easy spending (grin). Custodial gold has the same effect in international gold paper players. Like these real estate agents, gold players now think they have USA bullion in the bank just because it’s been placed in a trailer! (big smile)

[…]

We just said that the term Deep Storage might indicate that this gold will not be used as long as the U.S. dollar is around in its present form, i.e. in particular not in order to back the currency with a gold reserve at a floating price in the same fashion as the Eurosystem does:

FOA (5/8/1999; 20:16:12MDT – Msg ID:5772)

BOE![…]

The US treasury cannot use gold as a backing reserve as the ECB does, because the BIS would claim it at $41 to settle trade imbalances. They have that authority and as such it leaves the US the only option of outright gold sales. However, with the dollar as “the” reserve currency, we can expect many nations to bid “aggressively” for any US gold. China, among others comes to mind! That is what America found when they tried to auction it’s gold in 1978. The Euro carries no such baggage.

[…]

FOA (5/21/1999; 11:27:15MDT – Msg ID:6570)

Reply[…]

Just because the US said, in 71 that it would not ship gold any more does not mean the dollar isn’t still a contract to represent it’s old international obligations. Every analysts makes comments like, “let them sent their army if they want it”, but that is simply not the way the world works. It’s cheating, fair and simple! Why didn’t the US send out all of it’s gold at $41 to the ounce, then go off the system? As Another say’s, “think long and hard on that one”!The entire international financial structure is based on procedure protocols that are not binding, repeat, not binding, but without them, the system will not work. If the BIS did not coordinate inter bank (CBs) transfers the whole system would stop. Using the same “line of reasoning”, the US cannot just back it’s currency with gold at say, $10,000 and start all over again. What manner of “rules of engagement” would prevent them from halting gold shipments again? “Come on”, people of the world are not that stupid!

No, the dollar would have to be totally destroyed, and a new currency, sanctioned by the BIS, and most likely controlled by them, would have to be created. The US will go down to the wire before that happens, therefore, the Euro was created!

[…]

In fact, at the beginning of that month of May 1999, the Bank of England had just announced their gold sales (Brown’s Bottom). On 19 May 1999, the governor of the Bank of France, Mr. Jean-Claude Trichet, said:

I will simply say that as far as I am aware–and this is not just the position of the Bank of France and our country, but also the position of the Bundesbank, the Bank of Italy and of the United States, and these are the four main gold stocks in the world–the position is not to sell gold.

The next day, on 20 May 1999, Alan Greenspan confirmed this in front of the House Banking Committee:

We should hold our gold. Gold still represents the ultimate form of payment in the world. Germany in 1944 could buy materials during the war only with gold. Fiat money in extremis is accepted by nobody. Gold is always accepted.

The position of the U.S. not to sell any of their gold was clearly communicated at that time.

Finally, here is FOA on why there has been no audit of the U.S. gold reserve.

FOA (12/19/1999 18:59:35MDT – Msg ID:21368)

Reply[…]

I think just about every other major country (outside the IMF / dollar faction) has private audits of their gold. Too date, it’s mainly been the US gold stocks that have worried people because the dollar is so leveraged over this holding. I understand that the gold is intact, but they don’t want to draw attention to it. Any audit only highlights how little gold is backing the trillions of dollar assets. That’s the reason for the stonewall.Too a lesser extent, any audit carries overtones of eventual dollar backing. Something the BIS would have a major say in as they could attach it at the old $42 rate. Let’s be serious here, if current international law demands the compensation of German slave labour and Swiss Gold value reparations, all hell would break lose for the payment of dollar backed gold confiscated in 71. Both the official and private levels would be after any gold backing our present dollar. The only way the US gold could come into play would be with a new currency. And any whiff of that process (an audit is the beginning) would literally tank the dollar big! Well before the fact. So, good luck to GATA and MR. Turk!

6. Whom Did Greenspan Address?

It remains to be understood why Greenspan was so eager to mention that foreign central banks would lease increasing amounts of gold should the price rise. Let us repeat the passage from his testimony, but this time with a different emphasis:

The vast majority of privately negotiated OTC contracts are settled in cash rather than through delivery. […] To be sure, there are a limited number of OTC derivative contracts that apply to nonfinancial underlying assets. There is a significant business in oil-based derivatives, for example. But unlike farm crops, especially near the end of a crop season, private counterparties in oil contracts have virtually no ability to restrict the worldwide supply of this commodity. (Even OPEC has been less than successful over the years.) Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.

So was there perhaps any private counterparty who had cornered the gold market around 1998? Somebody to whom Greenspan wanted to signal that there would be enough gold available thanks to the leasing by his European colleagues? (Unfortunately, he had this only partly right because, as we have learnt from Another above, at that time, the Bundesbank had already enforced the end of the gold leasing by the central banks of Europe).

The first hints on the cornering of physical gold are contained in the messages on the old Kitco forum, some of which are preserved in Before the Thoughts! and Before the Trail. Later, Another has summarized it as follows.

Date: Thu Oct 09 1997 19:00

ANOTHER ( THOUGHTS! ) ID#60253:[…]

What of the LBMA mess?Gold is cornered. Plain and simple. No complicated theories, no options problems. The commodity value of gold was forced so low in paper currency terms that all of the new mined gold, going out some 10 years is spoken for. Between the third world buying physical gold and the jewelry industry ( same people buying ) there is none left for the oil states! They do value oil in terms of gold, but not IN the paper currency price of gold! How much is gold worth in terms of oil value? Just stop supplying gold to them in ultra cheep US$ terms and you will find out by watching the currency price of oil! In any event, LBMA has traded so much paper/oil/gold that any rise in the currency price of gold will implode them. The CBs must become the full primary suppliers of gold or the system as we know it is done.

One last note: No form of paper wealth will survive the financial crush once the CBs stop selling!

NOTHING!

Date: Fri Oct 10 1997 17:26

ANOTHER (THOUGHTS!) ID#60253:Yes, we could go into details about the LBMA mess. But why? They are in way over their heads and the final outcome is on it’s way.

A big change in the gold market actually started last spring. You couldn’t tell by the charts or news stories but it had the CB trading rooms going nuts. Up untill then they were using 3rd party transactions to sell, then the boomshell hit that the Merchant Banks were doing deals for 10 to 20 times what was offered! Well “boys will be boys” and someone is now stuck, big time! That’s why “Big Trader” and his bunch closed out all paper and pulled in bullion. Don’t worry about the CBs selling everything, the market is huge compared TO WHAT THEY HAVE! And Comex is nothing, if “only a silly game”. Worldwide trading in gold could be cut in half and still equal all the metal in existance!

The CBs will have to sell outright now even as the currency price of gold starts to run away from them!

The market is changing now,,, it will go up but you will not be happy with the outcome.

Date: Sun Oct 12 1997 10:42

ANOTHER (THOUGHTS!) ID#60253:[…]

Well a funny thing happened right after the Gulf war ended. What looked like big money before turned out to be little money as some HK people, I’ll call them “Big Trader” for short, moved in and started buying all the notes and physical the market offered. The rub was that they only bought low, and lower and cheaper. They never ran the price and they never ran out of money. Seeing this, some people ( middle east ) started to exchange their existing paper gold for the real stuff. From that time, early 1997 LBMA was running full speed just to stay in one spot! In other words paper volume had to increase to the physical volume on a worldwide scale, and that was going to be one hell of a jump. It could not be hidden from the news any longer.This was not far from the time that “Big Trader” said that “if gold drops below $370 the world would see trading volume like never before seen”. The rest is history. Now the CBs will have to sell 1/3 to 1/2 of their gold just to cover whats out there. To use the Queens English “it ain’t gona happen dude”! […]

Date: Sun Oct 19 1997 17:26

ANOTHER (THOUGHTS!) ID#60253:[…]

The Asians are the problem, by buying up bullion worldwide and thru South Africa they created a default situation on all the paper for the oil / gold trade! Now the CBs are selling in the open to calm nerves but it’s known that they will never sell enough. It was never their intent to provide the gold, only the backing until new mining technology could increase production. Over time the forward sales, such as ABX’s should have worked. But LBMA went nuts with the game and the whole mess has now accelerated.

Obviously, Greenspan had a very good reason to reassure the holders of unallocated gold that the central banks would lease enough for their allocation requests to be honoured.

In his article More Proof (21 April 2003), James Turk summarized the import/export statistics of gold for the United Kingdom. For example, in the statistics for the 1960s and 1970s, one can even see a glimpse of the operation of the London Gold Pool (Figure 10). Indeed, the gold pool grew during the early 1960s, but it suffered from a huge outflow in 1967 and 1968 (Note that this is the import/export statistics, and so it captures only the flow of gold into and out of the United Kingdom, but not the reallocation of gold to new owners inside the United Kingdom).

Figure 10: Net Import of Gold into the United Kingdom 1962-1976 (source: James Turk)

During the 1990s, we see an unprecedented outflow of gold of almost 2500 tonnes in 1997 (Figure 11):

Figure 11: Net Import of Gold into the United Kingdom 1992-2002 (source: James Turk)

According to Another, as quoted above, this must have been ‘Big Trader’ allocating the accumulated paper and then OPEC countries panicking and allocating, too. Moreover, this gold appears in the import/export statistics and was therefore removed from the United Kingdom.

7. Further Pieces of Information

Germany

Germany’s Bundesbank just announced the location of their gold reserve of 3396 tonnes (1036 tonnes in Frankfurt, 1536 tonnes in New York, 450 tonnes in London, 374 tonnes in Paris). From their report, it can also be seen that they relocated 930 tonnes from London to Frankfurt ‘at the beginning of the last decade’, yet, they only reported this fact on 25 October 2012. They also said that none of their gold is on loan as of today.

The salespeople of the gold investment industry often claim that the Bundesbank could not access their gold in New York, that the U.S. had already leased it all, or that the U.S. would view this gold as a collateral in order to impose political conditions on Germany.

Having read Another’s and FOA’s quotes above, we know that nothing would be further from the truth. Germany could just threaten to sell their U.S. dollar reserve in order to purchase 1536 tonnes in the open market which would immediately break the dollar gold market and collapse the U.S. dollar.

The real threat here is not the U.S. threatening to confiscate the German gold (and so Germany would not be able to sell this gold in order to defend the Euro). The real threat is rather Germany threatening the U.S. to purchase additional gold outright in the market, either using their U.S. dollar foreign exchange reserves or even with freshly printed Euros (and thereby collapsing the U.S. dollar as a reserve currency).

Update: As of 30 January 2013, the Bundesbank have released the locations of their allocated gold, the amount on lease or swapped as well as the amount of unallocated gold (sight accounts) they have held and a list of all their gold transactions.

This move by a central bank to publish a full history of their gold transactions and storage locations which makes fully transparent which part of the gold was allocated, unallocated, swapped and leased out, is totally unprecedented. We see about 200 tonnes of unallocated gold until 1997, about 740 tonnes swapped between 1979 and 1997, and up to 250 tonnes leased out between 1997 and 2008. Most of this is entirely in line with Dimitri Speck’s and our analysis above. A new piece of information is the large amount of swaps closed in 1997. In 1997, the Bundesbank converted a net amount of about 790 tonnes from `paper gold´ to `physical gold´ by allocating the 200 tonnes of unallocated, closing 740 tonnes of swaps, and only leaving 150 tonnes leased out. This must have tremendously increased the pressure on the London gold market in 1997. This information is a nice corroberation of Another’s remark

Date: Wed Nov 12 1997 20:41

ANOTHER (THOUGHTS!) ID#60253:[…] A BIS meeting was held and from those doors the world did change. The Bundesbank has now made clear to all what will now be policy for CBs. A crisis is at hand! All physical gold sales will stop. All gold lending will wind down. We will see the results of this as a massive scramble to cover open positions slowly unfolds. […]

It suggests the interpretation that the Bundesbank is the major gold power besides the U.S. and that they took quite a hard line approach, both risking a collapse of the dollar before the Euro was introduced and perhaps even forcing the Bank of England to sell some of their gold in order to rescue the London bullion banks. These Bundesbank publications also confirm that they relocated about 930 tonnes from London to Frankfurt between 1999 and 2001. They did not report this fact for another ten years.

In light of these events, it is even more remarkable that the Bundesbank publishes all these data now, in the beginning of 2013. Given their position as the major gold power besides the U.S., this must be interpreted as a signal to the rest of the world. I summarized my idea by tweeting

The Bundesbank is telling the rest of the world: We are all physical now. How about you?

At the same time, the Bundesbank announced that they would repatriate some 350 tonnes from New York to Frankfurt over the next seven years for about 50 tonnes per year. Gold bugs immediately claimed that the U.S. either did not have the gold or that they denied Germany the shipment in order to use the gold as a dead pledge and blackmail Germany. I do not think the U.S. can afford to do this and wrote at FOFOA’s blog

Here is a related remark. These days, the goldbugs on all channels hyperventilate about the Bundesbank being unable to recover their gold from New York.

This talk completely misses the point. The threat is not that the Bundesbank would retrieve the gold and then sell it in order to defend the Euro. This is IMF-think.

The real threat to the position of the U.S. is that the Bundesbank might purchase gold in the market: “Hey, Timmy, ship us the gold. If you don’t we buy twice that amount in the market.” Timmy will call FedEx before you can say “GLD Puke”.

Finally, the Bundesbank have demonstrated that they were willing to relocate 930 tonnes from London to Frankfurt. They just carried out this business and remained silent about it for more than a decade. So why are they now asking openly for the repatriation of gold from New York to be shipped to Frankfurt, but only for 350 tonnes, and even this spread out over several years? MF explained it in a discussion at Zero-Hedge. Here is my summary at FOFOA’s blog:

At ZeroHedge, I repeated my argument that the US will not confiscate the European gold (nor will they illegally lease or swap it out). Then:

Börjesson: All well and good, but that doesn’t really answer the question. Why the seven years? Presumably, since the Germans have such leverage, they’re only letting it take so long because they want to. But why? If the gold is really there, then why not just ship it over and have done with it?

VtC: Cause it doesn’t matter. The US government cannot afford to cheat, and so why care?

Recall that the Bundesbank shipped some 930 tonnes from London to Frankfurt in 2000 and 2001, and they didn’t tell anyone for a decade (it came out last fall when they published where their gold is stored).

So if they now make a fuss about 50 tonnes, then the point is the fuss rather than the 50 tonnes, no?

MF: What possible action could the Bundesbank have taken that would invite more notice and speculation? The only other is asking for everything immediately…but that would crash the gold market immediately and they would be blamed. This is a nice strategic move.

Germany : We only asked for a little gold, you can’t blame us.

ROW : Wth..hyperventilating.

Germany #winning

Börjesson: Why would asking for immediate delivery of all the gold crash the gold market, assuming that it’s actually there in the NY vaults and not leased to anyone? The Germans already own the gold, so nothing changes ownership, it’s just a matter of transport logistics. Right?

Now if the gold WASN’T there anymore, if asking for it all back would force the US to go buy some in the open market, or else mine it pdq, THEN I can see why it might have an effect on the markets. Is that your position?

MF: Because of the panic it would create. It would show an extreme lack of trust at international level between some of the most powerful entities that exist.

To others it would imply that the Bundesbank knows something they don’t (true most of the time anyways) and perhaps expect imminent collapse. That will send others scrambling for gold, even if there was no reason for panic (and the huge paper gold versus real gold ratio is reason enough for panic NOW).

That would break the market. Even though the Bundesbank would get every ounce from the Fed, just this action of asking will break things.

Switzerland

According to this speech by Thomas J. Jordan, Chairman of the Governing Board of the Swiss National Bank (SNB), about 70% of the 1400 tonnes of gold reserve of the SNB is stored in Switzerland, 20% at the Bank of England and 10% at the Bank of Canada.

Austria

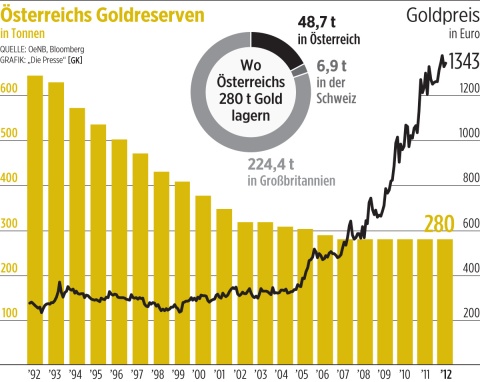

Axel Merk pointed me to two articles (here and here) in the Austrian newspaper Die Presse of 21 and 22 November 2012, according to which the central bank of Austria (Österreichische Nationalbank) has gold reserves of 280 tonnes (224.4 tonnes in London, 6.9 tonnes in Switzerland and 48.7 tonnes in Austria). In 2000, they had up to 80% of their gold reserve on loan. As of today, the amount of gold on lease has been reduced to 16%, i.e. to about 45 tonnes. The following diagram (Figure 4) from the second article nicely supports our claim: The central banks of the Eurosystem kept selling gold until 1999, but then they stopped the sales (and even have been gradually recalling the leased gold):

Netherlands

Jaco Schipper sent me this letter in which the Minister of Finance of the Netherlands confirms that the central bank of the Netherlands stopped lending gold in 2008.

He also translated some questions and answers with the Dutch minister of finance for me according to which 49% of their official gold reserve is in New York, 20% in Ottawa, 20% in London and 11% in Amsterdam.

Question 12. Can you explain why the relative DNB gold ownership was brought more in line with other gold-holding countries, as was noted in the previous questions?

Question 13. What amount in gold stock do you think should serve as ultimate reserve?

Question 14. Can you give an example of a situation where a claim to the Dutch gold reserves as ultimate reserve should be made?

Answer to question 12 through 14. Since the end of the Bretton Woods gold has no explicit function in terms of backing money. Nevertheless, it still contributes – [albeit] more indirectly – to the confidence in the financial system. The process of European monetary integration in the early nineties led to a reassessment of the size of the gold stock. Gold was at that time a very large share of total foreign exchange reserves of DNB. Also, the stock in relative terms was considerably higher than the European average. This prompted DNB to sell the gold stock in part to bring it more in line with those of other countries. Hereby, it still was considered prudent for a small country like the Netherlands to keep holding more than an average gold stock in comparison with other central banks. Also nowadays, DNB reviews the amount of gold reserves from a international perspective. A claim to the gold stock as ultimate reserve can be done for example in an extreme crisis in which liquidity is necessary to meet financial obligations. The gold would then be used as collateral.

Ireland

Aaron at FOFOA’s mentioned an article in The Independent (Republic of Ireland) according to which the Central Bank of Ireland whose gold reserve is tiny with only 6 tonnes, had not entered into any lease arrangements regarding any of its gold. Most of the official Irish gold was stored at the Bank of England.

Update (18 July 2013)

It is very nice to see that Sprott and Bordeleau read this article and paraphrase large parts of it in their Central Banks, Bullion Banks and the Physical Gold Market Conundrum.

I’d like to seize this opportunity to add the following:

1) The IMF sold some gold in 2009 and 2010 which, as I argued, may have been on lease since 2007 and 2008 when an equal weight of gold left the vault at the Federal Reserve Bank of New York. (Or, perhaps, someone else initially leased that gold and a large part of the IMF sales were later used to “fill these gaps”).

This will be the last gold to be leased or sold by the IMF. If I remember correctly, the remaining IMF gold listed in the tables is essentially still under control of the contributing countries and is not available for sale without any major international agreement. The most likely cause of action is that this gold will eventually be returned to the respective countries when they leave the IMF. We have speculated that the Europeans eventually will.

2) I don’t think Sprott and Bordeleau quite grasp the signal function of the Washington Agreement. The point of the agreement was not to announce that there will be gold sales, in a limited fashion such as not to depress the price too much, but rather that there will be no further physical gold supplied to the market. This happened as early as September 1999!

Everyone who was an insider of the London gold market in 1999 and who read the line “2. The undersigned institutions will not enter the market as sellers, with the exception of already decided sales.” would immediately understand the significance of the term “already decided sales”. It was absolutely clear in September 1999 that the Euro zone would not give away any further gramme of physical gold after this announcement. And, indeed, the London market almost went upside down during the subsequent week (which coincided with the most negative GOFO of all time, by the way) and was allegedly only rescued by Brits and Americans. No help for the bullion banks from the Euro zone!

The publication of the history of gold transactions by the Bundesbank earlier this year may have the same significance.

FOFOA

Please see FOFOA’s Happy New Year and Legs for further remarks on the European central bank activities in the gold market and further quotes of Another and FOA.

Acknowledgements